By Perfecto T. Raymundo Jr.

QUEZON CITY –- The Pag-IBIG Fund (Home Development Mutual Fund) on Thursday (Sept. 11) revealed the affordable housing unit and condominium unit available for its 29 million members.

In a press conference at the Philippine Information Agency (PIA), the Pag-IBIG Fund (Home Development Mutual Fund) gave updates on the Expressanded Pambansang Pabahay Para sa Pilipino (4PH) Program.

Jack C. Jacinto, Jr., Vice President, Public and Member Relations Group and Strategic Marketing Group, presented the benefits from Pag-IBIG Fund.

Jacinto explained the benefits on savings or program on savings, foremost of which is the Expanded Pambansang Pabahay Para sa Pilipino (4PH) Program of President Ferdinand R. Marcos, Jr.

He said that all Filipino workers with at least a minimum salary of P1,000 per month are members of Pag-IBIG Fund.

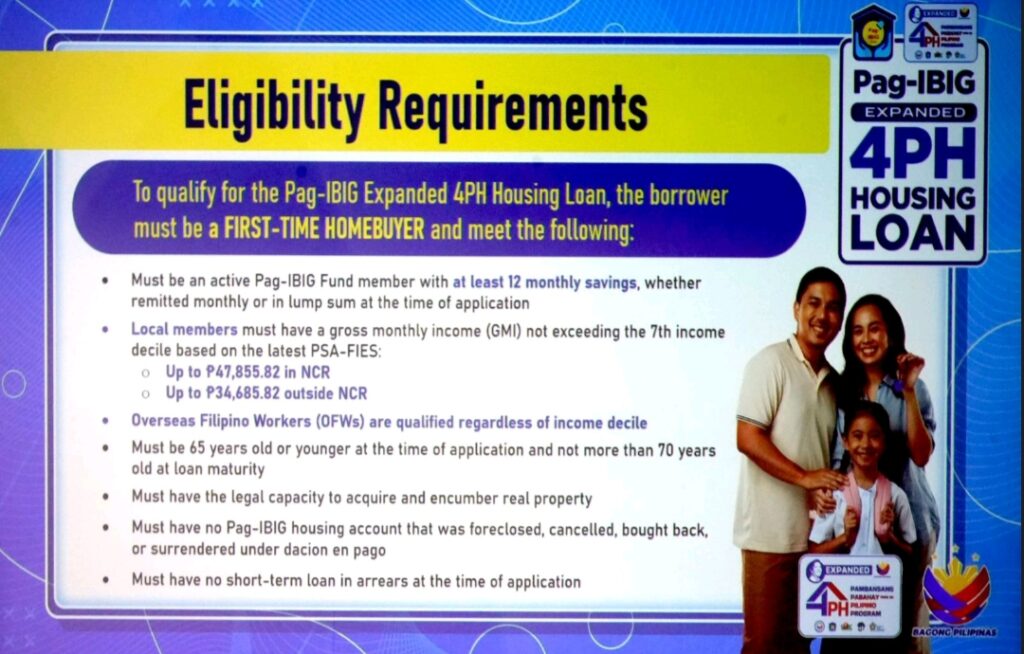

He added that self-employed individuals are also covered by Pag-IBIG Fund, as well as the Overseas Filipino Workers (OFWs), who are considered as the modern heroes, for as long as they are first time buyers, can also avail of the benefits of Pag-IBIG Fund.

Both public and private workers are covered by Pag-IBIG Fund, including the members of the Armed Forces of the Philippines and the Philippine National Police.

The mandate of Pag-IBIG Fund includes Provident Savings, and Home Financing.

As of June 2025, Pag-IBIG Fund, which is owned by members themselves with 16.79 or almost 17 million active members, with 29 million actual members, including those who have not been paying their contributions for the last 6 months.

P58.13 billion is the total amount of housing loans availed of by 37,927 or almost 38,000 were able to have their own houses.

On the Multi-Purpose Loans, there was a total of P42.86 billion availed of as of June 2025, benefiting 1,641,814 members.

1.6 million members were able to obtain cash loans.

Net income of P33.32 billion with members’ savings of P80.67 billion.

The benefits and services are Pag-IBIG regular savings or the contributions with dividend rate of 6.6% as of 2024, P200 from the member and P200 from the employer, which can be increased by the member;

MP2 savings, multi-purpose loans, loyalty card, which is voluntary savings program offered by Pag-IBIG, which will be kept for 5 years, with 7.1% return rate as of 2024;

Multi-purpose loan with 1.6 million members who have already availed at the half of the year, who have 12 months of contributions, including the employers’ counterpart and the interest.

Virtual Pag-IBIG mobile app is working on Android as well as on Iphone which can be applied online and released in three days and will be credited to the Pag-IBIG loyalty card, where cash loans and other benefits are credited, with 500 establishments or partners.

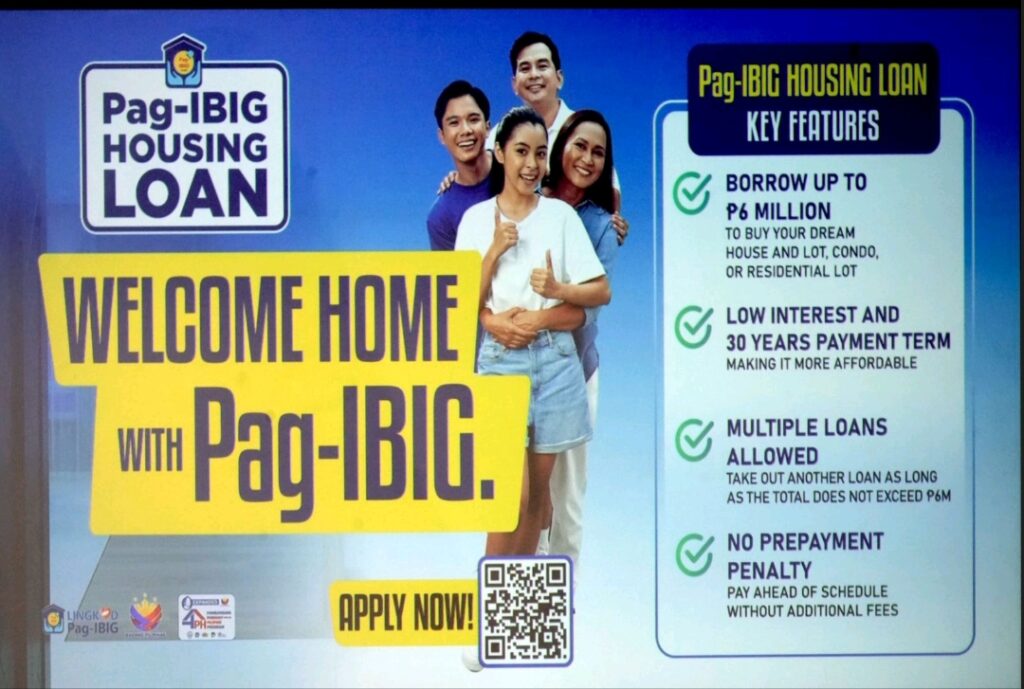

On Housing Loan, more than 100,000 Pag-IBIG members are able to get their own house through housing loan which can be easily applied, where the total amount of loan can be up to P6 million.

Home Improvement Loan for the renovation, repair and extension of a housing unit, where P300,000 can be availed of.

With the help of Virtual Pag-IBIG, with almost 4 million members already have their respective Virtual Pag-IBIG, with corresponding mobile app on Google Play and App Store, where members can apply for the benefits or programs.

94% of the members are paying on their Housing Loan on time, and those who were not able to settle their loans, the housing units are foreclosed and they are now being offered to other members.

Up to 40% discount is now being offered for the Pag-IBIG acquired assets with additional discounts and open until Dec. 14, 2025.

The super sale started on Aug. 25, 2025 where 2,000 housing units were offered for bidding and 6,000 participated in the online public auction.

Even non-Pag-IBIG members can bid or purchase the Pag-IBIG acquired assets which can be settled for 12 months or in cash.

It can be done or the bidding online for the Pag-IBIG acquired assets via Pag-IBIG online.

All the acquired assets are posted on the Pag-IBIG website and are now on super sale of up to 40% discount.

On the Expanded Pambansang Pabahay para sa Pilipino Program, where P850,000 for a socialized house and lot with horizontal development or up to P1.8 million for a condominium unit can be availed of.

The 4PH Program is through collaboration with the National Housing Authority (NHA) and Department of Human Settlements and Urban Development (DHSUD) Secretary Jose Ramon “Ping” P. Aliling.

According to Jacinto, Aliling was able to get the commitment of the private sector for the 250,000 housing units over the next three years.

For the low income and medium income earners with income of P47,000 and below and P34,000 outside of NCR are also eligible for the housing loans.

30,000 is the early bird, and as of yesterday, 26,000 have already signed up in the 4PH Program, with 3% interest for the first year.

The Rental Housing Program, with rental housing loan, to address the needs of Pag-IBIG is also being offered.

The Home Savers Program is helping the Pag-IBIG members to be able to cope up with the payment of their housing loans under a restructuring program and before it is foreclosed, there is still a redemption period and it can still be leased.

As of August 2025, almost 400,000 members have availed of the Pag-IBIG Calamity Loan.

JTR Reports 091125–MHE